Forecasts & 2025 Budget

President Biden released the 2025 budget, and while reading through it, I wondered how accurately previous administrations projected key metrics such as – revenues, outlays, deficits, GDP (economic growth), and our debt. I went back in 5-year increments to President Bush’s 2005 budget and compared all their estimates with reality. Of course, nobody predicted the financial crisis of 2008, or that we’d have a global health pandemic. But that’s life. Things happen that we don’t expect. Sometimes good and sometimes bad.

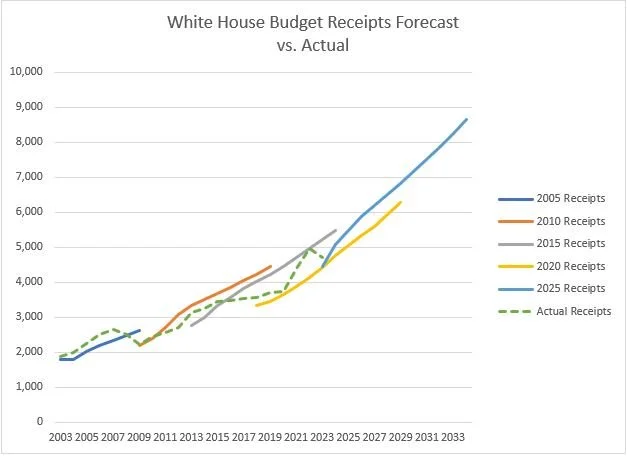

All presidents, with exception to President Trump, forecasted Federal revenues to be higher than what they were. President Bush also had conservative expectations, but because of the recession in 2008, revenue fell and finished below his 2009 expectation.

Source: JP Studinger Group

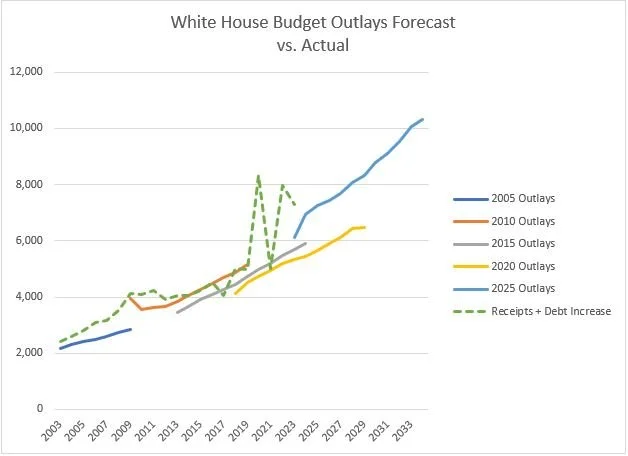

All presidents, with exception to President Obama’s 2010 budget, forecasted Federal expenses to be lower than what they were. His forecasts through 2019 were outlays of $5.2 trillion. Actual outlays were $5 trillion. Pretty darn close. I measure actual outlays by adding receipts and increases to federal debt. However, Obama’s spending forecasts in the 2015 budget were more optimistic and fell short of reality. While Trump’s office forecasts were close on the revenue side, expenses were way off. The 2020 pandemic took spending to new stratospheres.

Source: JP Studinger Group

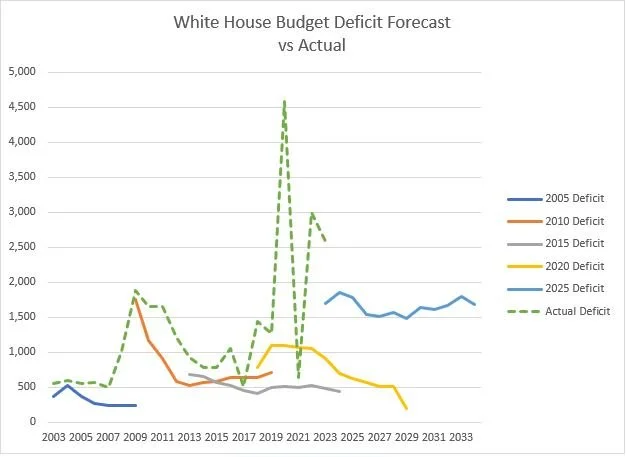

On the Nation’s annual deficit, Obama’s 2010 forecast was close. At least it followed a similar trend, although somewhat optimistically. None of the others were anywhere close to reality.

Source: JP Studinger Group

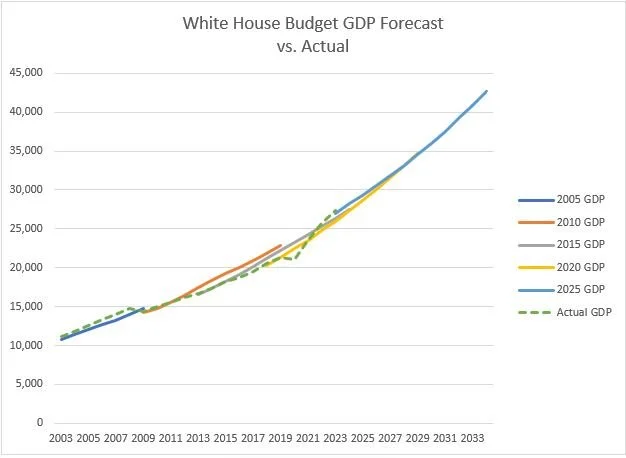

So how well did they forecast GDP/economic growth? Here they were much better. Bush estimated low. Obama estimated too high at first, but his budget forecast of 2015 was more accurate. Trump estimated low. And Biden’s 2025 budget is all forecast, so there’s no actual data to compare yet.

Source: JP Studinger Group

Here’s the takeaway. Over the past 20 years, the growth of our economy has been predictable. Along the way some crazy things happen, and the government has taken the blows with new debt. But America marches forward.

I continue to believe that we are amid an economic and market recovery. That there are more opportunities than there are problems. And that by the end of the year, or hopefully no later than mid-2025, we will see a full market recovery from the decline of 2022.

The “full market” recovery is different from what is seen in the large stock indexes – like the DOW, S&P 500, and the Nasdaq. They all have hit new highs. But those levels are pushed up by some very large companies. While many smaller companies are still below their previous market peaks, as can be represented by the Russell 2000 index, which is still about 20% below the November 2021 peak.

James Studinger

Sources:

U.S. Budget Data: https://www.govinfo.gov/app/collection/budget

U.S. Federal Reserve: https://www.federalreserve.gov/releases/z1/